- Mon - Sat: 8.00 - 18.00

- 411 University St, Seattle

- +1-800-456-478-23

Wholesale Investment Secrets

our portfolio

Our Latest Case Studies

Why Pay Someone Else to Drive?

Let’s be honest—no one enjoys being dictated to. You’ve built your business and achieved success through diligence and astute decision-making. The idea of handing over control of your finances might not appeal to you. At Solomons Group, we understand this desire for independence. That’s why we don’t act like chauffeurs—we give you the keys to a high-performance vehicle and a clear roadmap. We equip you with the tools, knowledge, and access you need to navigate your financial journey exactly as you envision it, keeping you firmly in control of your financial future.

But we also understand that control doesn’t always mean managing every detail. For those who prefer to focus on the big picture, we’re here to take care of the day-to-day execution. You make the decisions, and we implement them seamlessly. Whether you want to drive or sit back and enjoy the ride, Solomons Group adapts to your needs, ensuring your wealth is managed the way you want.

“You cannot make progress without making decisions.”

– Jim Rohn

Why Do Clients Want to be a

Wholesale Investor?

Why Do Clients Want to be a

Wholesale Investor?

Client-Driven Investment Strategies

Wholesale investment advice empowers you to take charge of your financial future. Unlike retail advice, which tends to be adviser-driven and instructional, wholesale advice places you in the driver’s seat. At Solomons Group, we provide the tools and resources you need to make informed decisions, giving you full control over your investment strategy. This approach appeals to those who prefer to actively engage in learning, exploring new opportunities, and steering their own course.

For others, wholesale investing is about having the freedom to delegate the intricacies. You may enjoy making the high-level decisions but prefer a trusted team to handle the execution. At Solomons Group, we offer both approaches—you remain in control of the strategic direction, while we take care of the details, ensuring everything runs smoothly behind the scenes.

Becoming a Sophisticated Investor

Not just about Capital, But Knowledge

Being a wholesale investor is not just about having significant capital—it’s about having the knowledge and sophistication to make well-informed investment decisions. At Solomons Group, we help you gain the insights and expertise necessary to navigate the complex world of wholesale investment with confidence. Our guidance ensures that you’re equipped to make strategic choices that align with your long-term goals.

But sophistication isn’t just about knowledge; it’s about knowing when to delegate. Some clients prefer to focus on the things that matter most in their lives, trusting us to manage their portfolio execution with precision. Whether you want to be hands-on with your investments or trust a team to handle the implementation, Solomons Group provides the flexibility to tailor our services to your style.

Why Get Verified?

In the past, even verified investors in Australia faced barriers to accessing the global investments they deserved. Verification alone wasn’t enough—without the right knowledge and capabilities, investors were left without the opportunities they sought. At Solomons Group, we change that. Drawing on our expertise from global institutions like Citibank, we provide verified clients with the access they need to sophisticated wholesale investments. With Solomons Group, you can confidently navigate the global investment landscape and unlock the opportunities that were once out of reach.

Whether you prefer to be actively involved in every decision or want to delegate the day-to-day management of your investments, verification with Solomons Group ensures that you have the access and expertise to meet your financial goals. We take care of the execution, so you can enjoy peace of mind, knowing your wealth is in expert hands.

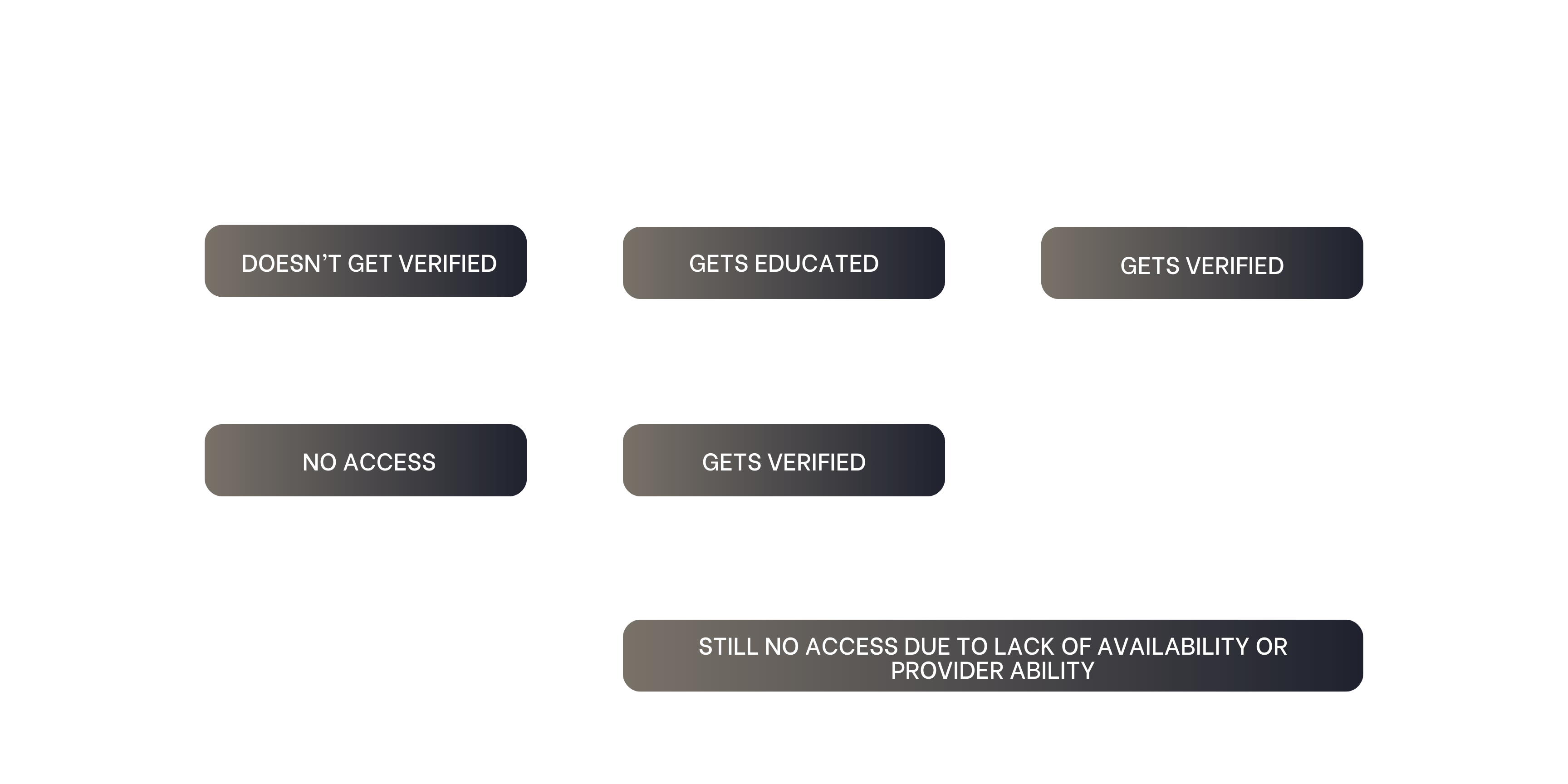

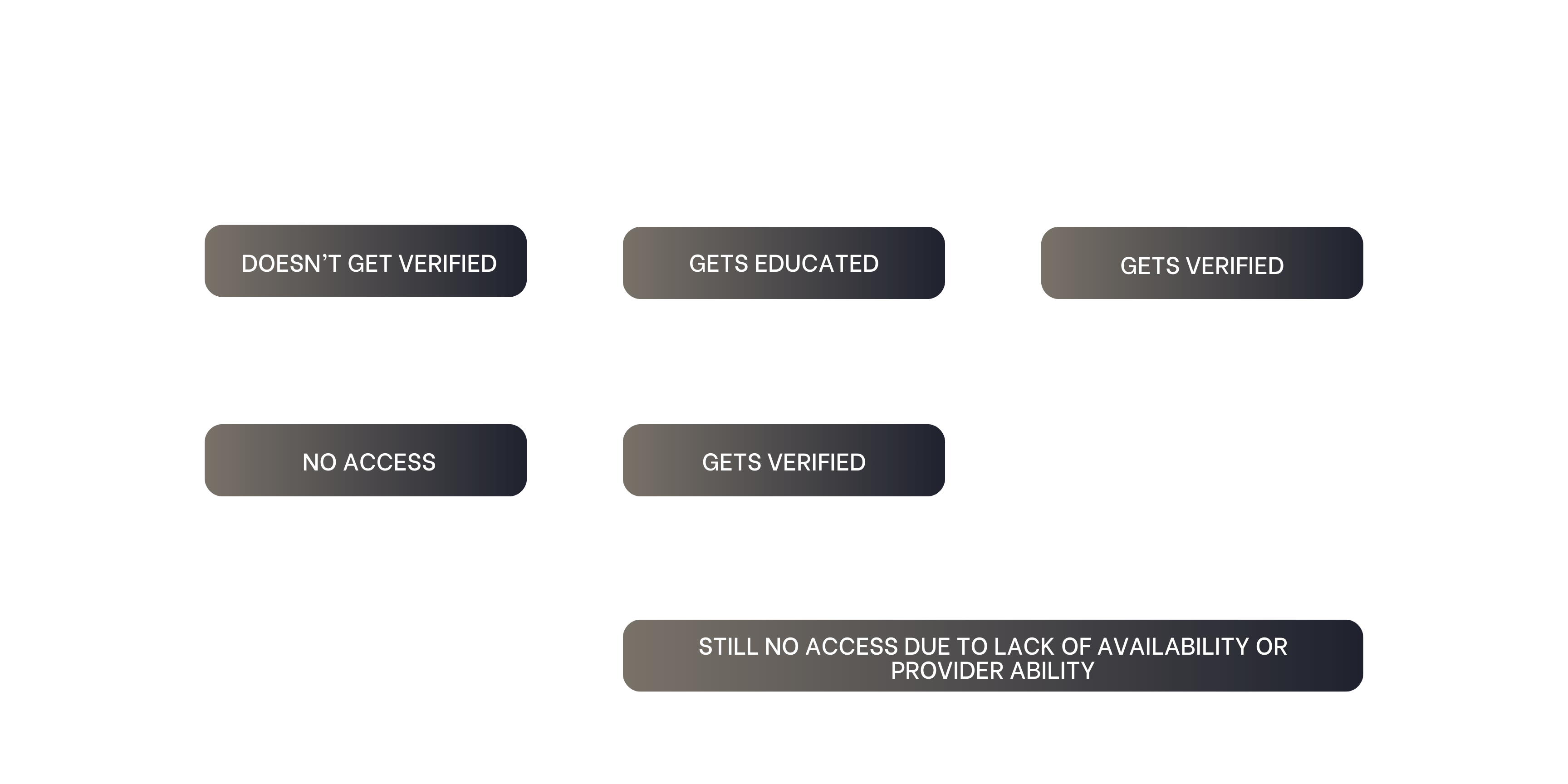

What Usually Happens:

The Challenge of Access in the Market

The closure of major private wealth arms like Citibank Gold left a significant void in the market.

Even verified investors found it nearly impossible to access the sophisticated investment opportunities they deserved.

This is where Solomons Group steps in.

Citigroup Exits Australian Consumer Banking After 36 Years, Shifts Focus to Institutional Business

Recently, Citigroup announced the sale of its Australian consumer banking division as part of a strategic review of its Asian retail operations. This marks the end of a 36-year presence in Australian retail banking for the global bank. Moreover, the decision comes as Citigroup aims to concentrate on institutional banking, including investment banking, capital markets, and advisory services, thereby supporting Australia’s transition to a low-carbon economy. Ultimately, this move aligns with Citigroup’s broader strategic goals and market focus.

Citigroup Exits Australian Consumer Banking After 36 Years, Shifts Focus to Institutional Business

Recently, Citigroup announced the sale of its Australian consumer banking division as part of a strategic review of its Asian retail operations. This marks the end of a 36-year presence in Australian retail banking for the global bank. Moreover, the decision comes as Citigroup aims to concentrate on institutional banking, including investment banking, capital markets, and advisory services, thereby supporting Australia’s transition to a low-carbon economy. Ultimately, this move aligns with Citigroup’s broader strategic goals and market focus.

CBA Puts High-Net-Worth Advice Business Up for Auction

Commonwealth Bank is set to divest its remaining ultra-high-net-worth advice business, Commonwealth Private Advice, marking the end of its extensive financial planning operations. This move is part of a broader strategy to reshape its wealth and private banking services. The bank’s exit from providing advice to retail investors began over four years ago, with a focus shift towards wholesale investment and sophisticated investors. The strategic review and subsequent sale of Commonwealth Private Advice reflect the bank’s continued efforts to streamline its wealth management activities.

CBA Puts High-Net-Worth Advice Business Up for Auction

Commonwealth Bank is set to divest its remaining ultra-high-net-worth advice business, Commonwealth Private Advice, marking the end of its extensive financial planning operations. This move is part of a broader strategy to reshape its wealth and private banking services. The bank’s exit from providing advice to retail investors began over four years ago, with a focus shift towards wholesale investment and sophisticated investors. The strategic review and subsequent sale of Commonwealth Private Advice reflect the bank’s continued efforts to streamline its wealth management activities.

About Solomons Group

At Solomons Group, our mission is to provide bespoke strategies and investment solutions that create lasting value for our clients.

A heritage of excellence and innovation in financial services, we are dedicated to helping you achieve your financial goals.

Revealing the Poorly Kept Secret of Wholesale Investors

At Solomons Group, we bridge the gap between Australian investors and sophisticated global investment strategies. While wholesale investments are a staple in financial hubs worldwide, they have remained elusive in Australia. Solomons Group changes this narrative by offering our clients unparalleled access to these exclusive opportunities, providing the tools and resources needed to engage confidently with global markets.

And for those who prefer a more hands-off approach, we offer a seamless experience where we manage every aspect of your investment strategy. You remain in control of the big decisions, while we handle the intricate execution. Our goal is to ensure that your wealth grows and evolves without you having to worry about the day-to-day details.

Our Founders Vision

Our founders, having witnessed the limitations of traditional institutions firsthand, are committed to providing clients with the access they deserve. The Solomons Wealth team includes top-tier advisers from global institutions like Citibank and Macquarie, as well as domestic banks like Westpac and Commonwealth Bank. With the closure of many private wealth arms, our advisers bring their extensive experience to Solomons Group, ensuring that you receive the highest level of service and access to exclusive opportunities. Whether they were part of institutions that couldn’t deliver or saw their clients deprived of opportunities, our team came together to create Solomons Group with a singular goal: to serve you better.

Our vision extends beyond just giving you access to investments. We understand that true wealth management means offering flexibility. Whether you prefer to manage your wealth actively or delegate the execution to trusted professionals, our team is here to deliver the solutions you need. You set the strategy—we handle the rest.

Meet Our Experts in Wholesale Advice from Citibank

Jobbe is a Partner of the Solomons Group and a qualified Private Wealth Adviser.

Jobbe has worked in Financial Services and Wealth Management for the past 8 years. He has worked in some well-known organisations including Citibank, Westpac and Commonwealth Bank of Australia. He always focuses on developing long-lasting relationships with his clients as his core aim. Through extensive research and continuous education, Jobbe aims to understand his clients and their respective needs and objectives through extensive research and continuous education to create both simple and complex strategies. In his most recent role with Citibank, he specialised in wholesale investment advice to HNW clients and migrant solutions including Significant Investor Visa (subclass 188c).

Jobbe is a Partner of the Solomons Group and a qualified Private Wealth Adviser.

Jobbe has worked in Financial Services and Wealth Management for the past 8 years. He has worked in some well-known organisations including Citibank, Westpac and Commonwealth Bank of Australia. He always focuses on developing long-lasting relationships with his clients as his core aim. Through extensive research and continuous education, Jobbe aims to understand his clients and their respective needs and objectives through extensive research and continuous education to create both simple and complex strategies. In his most recent role with Citibank, he specialised in wholesale investment advice to HNW clients and migrant solutions including Significant Investor Visa (subclass 188c).

Daniel is an Associate Director at Solomons Group, a qualified Private Wealth Advisers with 7 years of experience in Banking, Financial Services and Wealth Management. Prior to joining Solomons, he worked for leading financial institutions like Citibank, BT Financial Group and Westpac, managing and providing tailored wealth management solutions for Ultra-High-Net-Worth and Family office clients. He has a focus on bringing strategies utilised by global investors to clients in Australia, making the latest and most effective techniques available to them.

He is passionate about educating his clients and helping them navigate the complexities of investing to achieve their financial goals. Daniel is committed to sharing the strategies used by other global high-net-worth investors to his clients to succeed and achieve their goals.

Daniel is an Associate Director at Solomons Group, a qualified Private Wealth Advisers with 7 years of experience in Banking, Financial Services and Wealth Management. Prior to joining Solomons, he worked for leading financial institutions like Citibank, BT Financial Group and Westpac, managing and providing tailored wealth management solutions for Ultra-High-Net-Worth and Family office clients. He has a focus on bringing strategies utilised by global investors to clients in Australia, making the latest and most effective techniques available to them.

He is passionate about educating his clients and helping them navigate the complexities of investing to achieve their financial goals. Daniel is committed to sharing the strategies used by other global high-net-worth investors to his clients to succeed and achieve their goals.

MEET YOUR ADVISERS

Our Success Stories

Explore how Solomons Wealth Management partnered with a high-net-worth investor to develop a customised investment strategy that outperformed the market. See how our innovative approach and market insights led to increased annual growth in their investment portfolio, surpassing their financial goals.

Get Verified, Gain Access

Verification with Solomons Group isn’t just a formality—it’s your ticket to accessing a world of exclusive investment opportunities. Our verification process ensures that you gain the access you need to make informed and impactful investment decisions. It’s time to get back into the drivers seat.

About Solomons Group

At Solomons Group, our mission is to provide bespoke strategies and investment solutions that create lasting value for our clients. With a heritage of excellence and innovation in financial services, we are dedicated to helping you achieve your financial goals.

what we offer

Make Digital Marketing Work For Your Business

We serve clients at every level of their organization, whether as a trusted advisor to top management or as a hands-on coach. Our clients’ needs are constantly changing, so we continually seek new and better ways to serve them.

Our firm has helped clients engaged in more than 100 different subsectors of the aerospace, space markets.

Explore More 01

Retail

Our firm has helped clients engaged in more than 100 different subsectors of the aerospace, space markets.

Explore More 02

Partnership Ecosystem

Our firm has helped clients engaged in more than 100 different subsectors of the aerospace, space markets.

Explore More 03

New Business Innovation

75

marketing analysis

65

business innovation

90

finance strategy

45

corporate management

main principles

Global Reach with Local Understanding

Exceptional Client Service

In healthy companies, changing directions or launching new projects means combining underlying strengths and capacities with new energy and support.

A Great Team and Winning Culture

In healthy companies, changing directions or launching new projects means combining underlying strengths and capacities with new energy and support.

A Commitment to Integrity, Fairness

In healthy companies, changing directions or launching new projects means combining underlying strengths and capacities with new energy and support.

testimonials

What People Say About Us

“We know a diverse workforce and an inclusive culture matters to our clients. Through philanthropy and employee volunteerism, we support the diverse communities where our employees live.”

Oliver Simson

client of company

“We know a diverse workforce and an inclusive culture matters to our clients. Through philanthropy and employee volunteerism, we support the diverse communities where our employees live.”

Mary Grey

Manager

“We know a diverse workforce and an inclusive culture matters to our clients. Through philanthropy and employee volunteerism, we support the diverse communities where our employees live.”