- Mon - Sat: 8.00 - 18.00

- 411 University St, Seattle

- +1-800-456-478-23

Bespoke Financial Advisory

Take Action Today to Secure Your Tomorrow

Every journey to financial freedom starts with a single step. Make yours today and harness the power of time to grow your wealth.

Discover how your early investments can blossom—use the calculator below to project your retirement savings and future financial milestones.

"The best time to plant a tree was 20 years ago.

The second best time is now."

– Chinese Proverb.

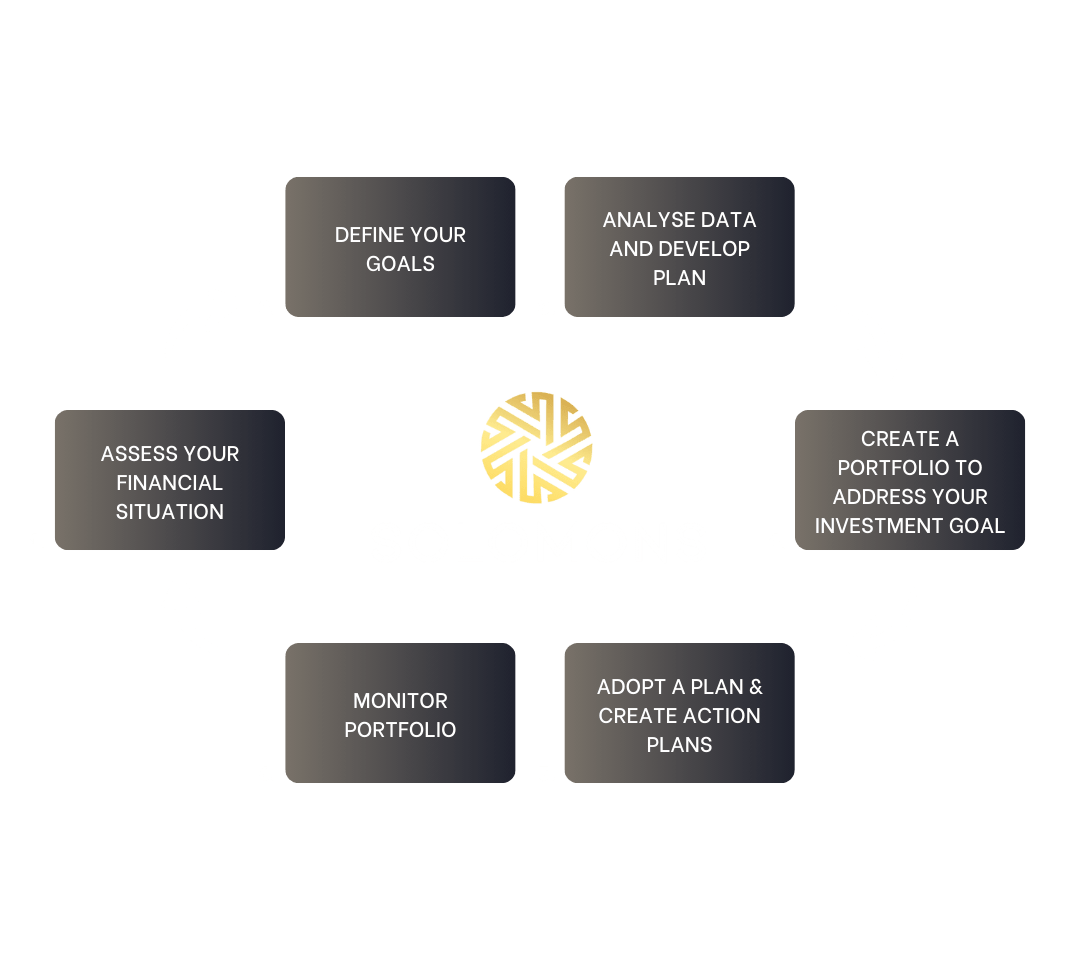

Your Financial Journey With Us

1. Access Your Financial Situation

We start by getting a clear understanding of your current financial picture. This includes reviewing your income, expenses, savings, and overall financial health. This is the foundation of your personalised plan.

2. Define Your Goals

Once we have a snapshot of your financial situation, we help you define your short- and long-term financial goals. Whether it’s saving for a home, growing your wealth, or planning for retirement, we align your plan with what’s important to you.

3. Analyse Data and Develop Plan

After understanding your goals, we analyse all relevant financial data to create a customised plan tailored specifically to your needs. This includes looking at investment opportunities, risk tolerance, and tax strategies.

4. Create a Portfolio to Address Your Investment Goals

Your personalised investment portfolio is built to help you reach your goals efficiently. We balance risk and reward, ensuring the right mix of assets to meet your financial objectives.

5. Adopt a Plan & Create Action Steps

With your plan in place, we work together to implement the strategies we’ve developed. We’ll outline clear action steps to get you on the path to achieving your goals.

6. Monitor Portfolio

We don’t just set up a plan and leave it. We continuously monitor your portfolio’s performance, making adjustments as necessary to ensure you stay on track, no matter how life or the markets change.

Assess Your Financial Situation

We start by getting a clear understanding of your current financial picture. This includes reviewing your income, expenses, savings, and overall financial health. This is the foundation of your personalised plan.

Once we have a snapshot of your financial situation, we help you define your short-and long-term financial goals. Whether it’s saving for a home, growing your wealth, or planning for retirement, we align your plan with what’s important to you.

Define Your Goals

Analyse Data and Develop Plan

After understanding your goals, we analyse all relevant financial data to create a customised plan tailored specifically to your needs. This includes looking at investment opportunities, risk tolerance, and tax strategies

Your personalised investment portfolio is built to help you reach your goals efficiently. We balance risk and reward, ensuring the right mix of assets to meet your financial objectives.

Create a Portfolio to Address Your Investment Goals

Adopt a Plan & Create Action Steps

With your plan in place, we work together to implement the strategies we’ve developed. We’ll outline clear action steps to get you on the path to achieving your goals.

We don’t just set up a plan and leave it. We continuously monitor your portfolio’s performance, making adjustments as necessary to ensure you stay on track, no matter how life or the markets change.

Monitor Portfolio

Starting Out

Building Wealth

Approaching Retirement

Retirement

Legacy and Wealth Transfer

Your Financial Journey with

Solomons Wealth

At Solomons Wealth, we’re with you at every stage of your financial journey. Whether you’re starting out, building wealth, preparing for retirement, or protecting your legacy, our tailored services ensure you reach your financial goals with confidence.

Starting Out

Building Your Financial Foundation

Find all the tools you’ll need to create advanced websites in one place. Stop waisting time searching for solutions.

• Cash Flow and Budgeting Guidance: Learn how to manage your income, expenses, and savings effectively.

• Debt Management: Let’s tackle student loans and credit card debt with a strategic plan.

• Superannuation Setup: Start contributing to your future now and reap the rewards later.

• First Home Purchase: We’ll help you save for a deposit and navigate government grants.

• Simple Investment Strategies: Build a diversified portfolio that grows with you.

Imagine: A clear roadmap to managing your finances, with every decision building towards your future goals.

Building Wealth

Growting And Protecting What You've Earned

As your career and family grow, so do your financial priorities. This stage is all about maximising your wealth and securing the future for yourself and your loved ones. We’ll help you make strategic decisions to grow your wealth while protecting what you’ve worked so hard to achieve.

• Superannuation Growth: Maximise your super contributions to ensure a comfortable retirement.

• Investment Planning: Build a diversified portfolio that reflects your financial goals.

• Tax Optimisation: Smart tax strategies that let you keep more of your hard-earned money.

• Insurance and Risk Management: Protect your family and income with the right insurance.

• Property Investment Advice: Whether it’s your family home or an investment property, we’re here to help.

Imagine: Confidently growing your wealth while safeguarding your family’s financial security.

Approaching Retirement

Preparing for the Next Chapter

With retirement on the horizon, it’s time to ensure your wealth is optimised and protected. We’ll work closely with you to make sure your financial strategy aligns with your retirement lifestyle goals, so you can enjoy the next phase of your life without worry.

• Retirement Strategy Development: Map out your retirement goals and set a plan to achieve them.

• Superannuation Optimisation: Consolidate your super accounts and maximise your retirement savings.

• Tax Planning for Retirement: Minimise your tax liabilities as you transition into retirement.

• Estate Planning: Ensure your wealth is passed on according to yourwishes, with minimal tax and legal issues.

• Income Management: We’ll help create a stable, sustainable income plan for your retirement.

Imagine: Entering retirement with peace of mind, knowing your finances are aligned with your dreams.

Retirement

Enjoying Your Financial Freedom

Now that you’ve reached retirement, it’s about maintaining your lifestyle and making sure your wealth lasts. We’re here to help you manage your income, protect your assets, and ensure you’re financially secure throughout your retirement years.

• Income Stream Management: Maintain a steady income flow to support your lifestyle.

• Wealth Preservation: Strategies to protect your wealth from market risks and inflation.

• Aged Care Planning: Get the financial advice you need to navigate the costs of aged care.

• Health and Long-Term Care: Plan for future healthcare costs and long-term care needs.

• Legacy Planning: Secure your family’s future with effective estate and legacy planning.

Imagine: Living the retirement you’ve always dreamed of, with financial security

and peace of mind.

Legacy and Wealth Transfer

Protecting Your Legacy for Future Generations

For high-net-worth individuals and families, protecting wealth across generations is a top priority. Our bespoke family office services are designed to manage complex financial needs, protect your wealth, and ensure a seamless transition to the next generation.

• Family Office Services: From asset management to tax planning, weprovide full-service solutions for your family’s financial needs.

• Estate Structuring: We’ll help you structure your wealth to ensure a smooth transfer to the next generation.

• Philanthropy and Charitable Giving: Make a lasting impact with strategic charitable donations.

• Business Succession Planning: Protect your family business with a clear succession plan.

• Wealth Governance: Set up family boards or councils to oversee and manage family wealth effectively.

Imagine: Preserving your legacy and ensuring your family’s financial security forgenerations to come.

Take Control of Your Financial Future

Wherever you are in life, Solomons Wealth Management is here to guide you. Our tailored financial services ensure that, no matter your current life stage, we’ll help you reach your financial goals. Use our financial tools to get started or contact us for a free consultation to discuss your needs.

Are You on Track?

Use our super contributions calculator to see the impact of additional contributions on your superannuation and retirement savings. It can also help you understand the difference between making before-tax (concessional) or after-tax (non-concessional) contributions. This calculator is a helpful tool but should not be solely relied upon for making financial decisions about your superannuation. We recommend seeking advice from a licensed financial adviser.

Notice

Important: This calculator currently uses rates and thresholds for the 2023-24 financial year and will be updated accordingly. When using the calculator, please be sure to read the limitations and assumptions to understand how it works.

Disclaimer

This calculator provides illustrative examples based on the assumptions provided and the information you enter. It is not a substitute for personalized financial advice tailored to your specific circumstances. The projected figures are for illustration only, are not guaranteed, and may differ from actual results. Please do not rely on this calculator for making financial decisions regarding any products, funds, or strategies. Actual outcomes will depend on various factors beyond the control of Solomons Wealth Management. We disclaim all liability for any actions taken based on the results of this calculator.

Important Considerations:

- This tool shows potential impacts of different contribution levels but does not account for factors like investment option variations, return fluctuations, or other assets and income sources.

- It does not consider your spouse/partner’s contributions, assets outside superannuation, or other income sources.

- Superannuation is generally inaccessible until retirement, which is not factored into these calculations.

This calculator is intended as a guide only, and its results rely on key assumptions detailed below. For accurate and tailored advice, we recommend consulting a professional financial adviser.

Assumptions

We believe the assumptions used in this calculator are reasonable for its intended purpose because:

- Current Tax and Super Laws: Assumptions including superannuation contribution percentages, Government co-contribution rules, and tax rates are based on current tax and superannuation laws, which are consistent with relevant legislation and do not consider future or proposed changes.

- Assumed Investment Returns: Assumed investment returns for each investment strategy are set by Solomons Wealth Management's Actuary based on our expectations for our investment options.

- Default Assumptions Compliance: The default assumptions in relation to retirement age, drawdown period, and wage and price inflation rates comply with default assumptions for superannuation calculators set by ASIC.

However, it’s important to keep the purpose of the calculator in mind and remember that it’s not intended for you to rely on it when making decisions about your superannuation. You should seek financial advice tailored to your circumstances and consider the relevant product disclosure statement (PDS) and target market determination (TMD) before making a decision to acquire or continue to hold any financial product.

Limitations

In addition to the specific limitations outlined below, this calculator only allows you to select a current age between 15 and 67 and a retirement age between 60 and 75. Because of this limitation, it is not suitable for use by people whose current age is outside that range and/or who do not plan to retire between the ages of 60 and 75.

The calculator is based on the relevant laws in force today. It does not take into account future changes to those laws. Future changes to the law may affect the accuracy of the results produced by this calculator, potentially significantly.

This calculator accepts an employer super contribution range between 10% and 25%. If you're self-employed and do not make super payments within this range to yourself, this calculator will not work for you.

Frequently Asked Question

What Can I Expect from My Super Advice Results?

Rest assured, the results will give you a clearer picture of how your super is tracking and what actions you can take to improve your future lifestyle.

Here’s what the results will show you:

- A Clear Path to Your Retirement Goals: Your results will outline the steps you can take to align your super contributions and financial strategies with your dream retirement lifestyle.

- Personalized Recommendations: Based on your financial situation, the results will include tailored advice on maximizing your super’s growth potential and managing any risks.

- Actionable Next Steps: You’ll receive guidance on specific actions, such as contribution strategies or investment options, that can help boost your super balance for the long-term.

Your financial future is important—this guide will provide the clarity you need to take control.

Why should I get financial advice on superannuation?

There are three main benefits to getting superannuation advice:

- Cost-Effective: It's included in your membership, so there's no extra cost impacting your budget or super balance.

- Expertise: Our qualified advisers specialize in super and insurance, giving you confidence in the advice you receive.

- Convenience: We offer advice over the phone, along with plenty of online resources like calculators, webinars, and podcasts to support your financial journey.

Are You on Track?

Notice

Important: This calculator currently uses rates and thresholds for the 2023-24 financial year and will be updated accordingly. When using the calculator, please be sure to read the limitations and assumptions to understand how it works.

Calculate Percentage of Income

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Disclaimer

This calculator is intended to provide illustrative examples based on the assumptions we’ve listed and the information you input. It is not a replacement for obtaining professional financial advice tailored to your individual circumstances. The projected figures generated by this calculator are not guaranteed, are provided for illustration purposes only, and may vary from actual results. You should not rely on this calculator when making decisions about any financial product, including specific products, funds, or strategies. Actual outcomes will depend on various factors beyond the control of Solomons Wealth Management. Solomons Wealth Management expressly disclaims all liability and responsibility to any person who relies, or partially relies, on anything done or omitted to be done by this calculator.

This calculator is intended to show the potential effects of different levels and types of contributions only, and it does not consider factors such as the impact of different investment options on your retirement outcomes or fluctuations in investment returns over time. It also does not account for whether you have a spouse/partner (or any spouse/partner contribution strategies), any assets outside superannuation, or income other than your salary.

You should also consider that superannuation generally cannot be accessed until you retire. The calculator is only a guide and its results rely on key assumptions that are outlined below.

Assumptions

We believe the assumptions used in this calculator are reasonable for its intended purpose because:

- Current Tax and Super Laws: Assumptions including superannuation contribution percentages, Government co-contribution rules, and tax rates are based on current tax and superannuation laws, which are consistent with relevant legislation and do not consider future or proposed changes.

- Assumed Investment Returns: Assumed investment returns for each investment strategy are set by Solomons Wealth Management's Actuary based on our expectations for our investment options.

- Default Assumptions Compliance: The default assumptions in relation to retirement age, drawdown period, and wage and price inflation rates comply with default assumptions for superannuation calculators set by ASIC.

However, it’s important to keep the purpose of the calculator in mind and remember that it’s not intended for you to rely on it when making decisions about your superannuation. You should seek financial advice tailored to your circumstances and consider the relevant product disclosure statement (PDS) and target market determination (TMD) before making a decision to acquire or continue to hold any financial product.

FAQs - Frequently Asked Question

What can I expect in my super advice appointment?

Don't worry, you don't need to be a maths whiz to get the most out of your advice appointment. You just need to think about the future lifestyle you want to enjoy, so your adviser can tell you what actions could help you get there.

To do this, here's our two easy steps to prepare for your advice appointment:

- Imagine your goals and dream retirement lifestyle: Once you have a picture of what the future looks like, it becomes possible to work towards making it happen.

- Fill in and send us your client questionnaire: To prepare your personalised financial plan, your adviser needs to know a bit about your financial situation. We'll send you a questionnaire in the email confirming your appointment.

Check our other tips for things you can do to prepare for your appointment.

Can I get free financial advice?

It depends on what type of advice you need. As a Solomons Wealth Management client, you can get financial advice about your super account as part of your membership.

We’re also happy to work with your financial adviser (if you have one) when you need comprehensive financial advice. In that case, your adviser will let you know what the fees are and the payment options.

Depending on your needs, you can get free financial advice from the Financial Information Service (FIS) at Centrelink (Services Australia) or the National Debt Helpline.

Is getting financial advice with my super fund the same as seeing other financial advisers?

When you get financial advice through your super fund, it's different to seeing an external financial adviser in two main ways:

- Content: We can only give you advice about making the most of your super with us, any insurance on your account, and using our retirement income products. An external financial adviser can give you advice about your entire financial situation, including any debts like a home loan, and investments outside of super.

- Cost: Getting advice about your super account with Solomons Wealth Management is included as part of your membership, so the cost is just the usual administration fee on your account. Seeing an external financial adviser may come with a cost, which your adviser can tell you about.

Why should I get financial advice on superannuation?

There are three main benefits to getting advice about your super:

- Cost-Effective: It's included in your membership, so it won't hurt your budget or decrease your super balance.

- Expertise: We've got qualified financial advisers who specialise in super and insurance, so you'll feel confident you know what to do next.

- Convenience: We offer advice over the phone and provide plenty of general advice online, including calculators, webinars, and podcasts.

Is financial advice tax-deductible?

You'll want to check with an accountant or tax adviser before you submit your tax return, because it depends on what type of advice you get. Some people may be able to claim a tax deduction on advice fees for investment advice if the advice helps them earn money from that investment.

If you get superannuation advice from our financial advisers here at Solomons Wealth Management, it's included in your membership. All you pay is the normal fees on your account, so there's no expense to claim a tax deduction on.

Your Guide to Achieving Financial Freedom

At Solomons, we know everyone’s financial needs are different. We’re here to help you find your way to financial freedom. Whether you’re saving for the future, investing, or protecting your family’s finances, we create plans that fit just right with your life and goals.

The Financial Planning Cycle

Financial Health Check

Take A Free Assessment

Understanding your financial health is the crucial first step towards achieving your financial goals. Our Financial Health Check is designed to give you a clear picture of key areas, including your superannuation, savings, investments, and more. With this quick assessment, you’ll uncover valuable insights into where you can enhance and optimise your financial strategy.

Start your journey today—take a financial health check to see where you stand and discover how Solomons can help you grow and protect your wealth. We’re here to guide you towards a brighter, more secure financial future.

Financial Health Check

what we offer

Make Digital Marketing Work For Your Business

We serve clients at every level of their organization, whether as a trusted advisor to top management or as a hands-on coach. Our clients’ needs are constantly changing, so we continually seek new and better ways to serve them.

Our firm has helped clients engaged in more than 100 different subsectors of the aerospace, space markets.

Explore More 01

Retail

Our firm has helped clients engaged in more than 100 different subsectors of the aerospace, space markets.

Explore More 02

Partnership Ecosystem

Our firm has helped clients engaged in more than 100 different subsectors of the aerospace, space markets.

Explore More 03

New Business Innovation

75

marketing analysis

65

business innovation

90

finance strategy

45

corporate management

main principles

Global Reach with Local Understanding

Exceptional Client Service

In healthy companies, changing directions or launching new projects means combining underlying strengths and capacities with new energy and support.

A Great Team and Winning Culture

In healthy companies, changing directions or launching new projects means combining underlying strengths and capacities with new energy and support.

A Commitment to Integrity, Fairness

In healthy companies, changing directions or launching new projects means combining underlying strengths and capacities with new energy and support.

testimonials

What People Say About Us

“We know a diverse workforce and an inclusive culture matters to our clients. Through philanthropy and employee volunteerism, we support the diverse communities where our employees live.”

Oliver Simson

client of company

“We know a diverse workforce and an inclusive culture matters to our clients. Through philanthropy and employee volunteerism, we support the diverse communities where our employees live.”

Mary Grey

Manager

“We know a diverse workforce and an inclusive culture matters to our clients. Through philanthropy and employee volunteerism, we support the diverse communities where our employees live.”

Samanta Fox

DesignerThe Financial Planning Cycle

Our Services at Solomons Wealth Management

At Solomons Wealth Management, we offer a comprehensive suite of services designed to help you at every stage of your financial journey. Whether you are focused on growing your wealth, protecting it, or ensuring a lasting legacy for future generations, our team is here to guide you.

Wealth Creation

We believe that building wealth starts with a solid plan. Our wealth creation services are designed to help you grow and maximise your assets, no matter where you are in your financial journey.

Starting Out: Building Your Financial Foundation

• Investment Management: Tailored investment strategies that align with your financial goals and risk tolerance.

• Superannuation Optimisation: Maximise your retirement savings and ensure your super is working for your future.

• Tax Optimisation: Implement smart tax strategies that allow you to keep more of what you earn.

• Debt Management: Strategies to reduce debt and improve cash flow.

• Property Investment: Advice on purchasing and managing investment properties.

• Superannuation Optimisation: Maximise your retirement savings and ensure your super is working for your future.

• Tax Optimisation: Implement smart tax strategies that allow you to keep more of what you earn.

• Debt Management: Strategies to reduce debt and improve cash flow.

• Property Investment: Advice on purchasing and managing investment properties.

Wealth Protection

Protecting your wealth is just as important as growing it. We offer solutions to safeguard your assets, ensuring you are prepared for life’s uncertainties.

Building Wealth: Growing and Protecting What You’ve Earned

• Insurance and Risk Management: Comprehensive coverage to protect your family, income, and assets.

• Estate Planning: Secure your legacy with careful planning for the distribution of your wealth.

• Income Protection: Ensure continued financial security in the event of illness or injury.

• Legal Structures for Protection: Utilise trusts and other structures to safeguard your wealth from risk.

• Estate Planning: Secure your legacy with careful planning for the distribution of your wealth.

• Income Protection: Ensure continued financial security in the event of illness or injury.

• Legal Structures for Protection: Utilise trusts and other structures to safeguard your wealth from risk.

Family Office & Intergenerational Wealth

For those with significant assets, our family office and legacy planning services ensure your wealth is preserved and passed on according to your wishes. We provide holistic solutions that go beyond wealth management.

Approaching Retirement: Preparing for the Next Chapter

• Family Office Services: Tailored solutions for ultra-high-net-worth families, offering everything from asset management to philanthropy.

• Estate Structuring: Ensure a smooth transfer of wealth to future generations with tax-efficient strategies.

• Business Succession Planning: Plan for the future of your family business, ensuring a seamless transition.

• Philanthropy: Establish meaningful charitable giving programs that align with your values.

• Estate Structuring: Ensure a smooth transfer of wealth to future generations with tax-efficient strategies.

• Business Succession Planning: Plan for the future of your family business, ensuring a seamless transition.

• Philanthropy: Establish meaningful charitable giving programs that align with your values.

Wealth Creation

We believe that building wealth starts with a solid plan. Our wealth creation services are designed to help you grow and maximise your assets, no matter where you are in your financial journey.

Starting Out:

Building Your Financial Foundation

• Superannuation Optimisation: Maximise your retirement savings and ensure your super is working for your future.

• Tax Optimisation: Implement smart tax strategies that allow you to keep more of what you earn.

• Debt Management: Strategies to reduce debt and improve cash flow.

• Property Investment: Advice on purchasing and managing investment properties.

Wealth Protection

Protecting your wealth is just as important as growing it. We offer solutions to safeguard your assets, ensuring you are prepared for life’s uncertainties.

Building Wealth:

Growing and Protecting What You’ve Earned

• Estate Planning: Secure your legacy with careful planning for the distribution of your wealth.

• Income Protection: Ensure continued financial security in the event of illness or injury.

• Legal Structures for Protection: Utilise trusts and other structures to safeguard your wealth from risk.

Family Office & Intergenerational Wealth

For those with significant assets, our family office and legacy planning services ensure your wealth is preserved and passed on according to your wishes. We provide holistic solutions that go beyond wealth management.

Approaching Retirement:

Preparing for the Next Chapter

• Estate Structuring: Ensure a smooth transfer of wealth to future generations with tax-efficient strategies.

• Business Succession Planning: Plan for the future of your family business, ensuring a seamless transition.

• Philanthropy: Establish meaningful charitable giving programs that align with your values.

Wealth Creation

We believe that building wealth starts with a solid plan. Our wealth creation services are designed to help you grow and maximise your assets, no matter where you are in your financial journey.

Starting Out:

Building Your Financial Foundation

• Superannuation Optimisation: Maximise your retirement savings and ensure your super is working for your future.

• Tax Optimisation: Implement smart tax strategies that allow you to keep more of what you earn.

• Debt Management: Strategies to reduce debt and improve cash flow.

• Property Investment: Advice on purchasing and managing investment properties.

Wealth Protection

Protecting your wealth is just as important as growing it. We offer solutions to safeguard your assets, ensuring you are prepared for life’s uncertainties.

Building Wealth:

Growing and Protecting What You’ve Earned

• Estate Planning: Secure your legacy with careful planning for the distribution of your wealth.

• Income Protection: Ensure continued financial security in the event of illness or injury.

• Legal Structures for Protection: Utilise trusts and other structures to safeguard your wealth from risk.

Family Office & Intergenerational Wealth

For those with significant assets, our family office and legacy planning services ensure your wealth is preserved and passed on according to your wishes. We provide holistic solutions that go beyond wealth management.

Approaching Retirement:

Preparing for the Next Chapter

• Estate Structuring: Ensure a smooth transfer of wealth to future generations with tax-efficient strategies.

• Business Succession Planning: Plan for the future of your family business, ensuring a seamless transition.

• Philanthropy: Establish meaningful charitable giving programs that align with your values.

Wealth Creation

We believe that building wealth starts with a solid plan. Our wealth creation services are designed to help you grow and maximise your assets, no matter where you are in your financial journey.

Starting Out:

Building Your Financial Foundation

• Superannuation Optimisation: Maximise your retirement savings and ensure your super is working for your future.

• Tax Optimisation: Implement smart tax strategies that allow you to keep more of what you earn.

• Debt Management: Strategies to reduce debt and improve cash flow.

• Property Investment: Advice on purchasing and managing investment properties.

Wealth Protection

Protecting your wealth is just as important as growing it. We offer solutions to safeguard your assets, ensuring you are prepared for life’s uncertainties.

Building Wealth:

Growing and Protecting What You’ve Earned

• Estate Planning: Secure your legacy with careful planning for the distribution of your wealth.

• Income Protection: Ensure continued financial security in the event of illness or injury.

• Legal Structures for Protection: Utilise trusts and other structures to safeguard your wealth from risk.

Family Office & Intergenerational Wealth

For those with significant assets, our family office and legacy planning services ensure your wealth is preserved and passed on according to your wishes. We provide holistic solutions that go beyond wealth management.

Approaching Retirement:

Preparing for the Next Chapter

• Estate Structuring: Ensure a smooth transfer of wealth to future generations with tax-efficient strategies.

• Business Succession Planning: Plan for the future of your family business, ensuring a seamless transition.

• Philanthropy: Establish meaningful charitable giving programs that align with your values.

Discover How We Can Help You Achieve Financial Success

Explore Our Capabilities Now

Real Stories, Real Results

Our Success Stories

See how Solomons Wealth Management helped a mid-career professional increase their retirement savings, setting them up for a comfortable and secure future.